Multiple Choice

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

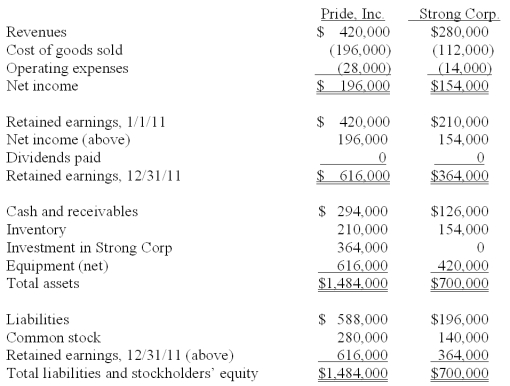

As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

-What is the consolidated total for equipment (net) at December 31, 2011?

A) $952,000.

B) $1,058,400.

C) $1,069,600.

D) $1,064,000.

E) $1,066,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: An intra-entity sale took place whereby the

Q72: Wilson owned equipment with an estimated

Q73: Stark Company, a 90% owned subsidiary of

Q75: Pepe, Incorporated acquired 60% of Devin Company

Q76: Stark Company, a 90% owned subsidiary of

Q78: Edgar Co. acquired 60% of Stendall Co.

Q79: Stiller Company, an 80% owned subsidiary of

Q82: On January 1, 2010, Smeder Company, an

Q99: Gentry Inc. acquired 100% of Gaspard Farms

Q112: What is the total of consolidated revenues?<br>A)