Multiple Choice

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired.

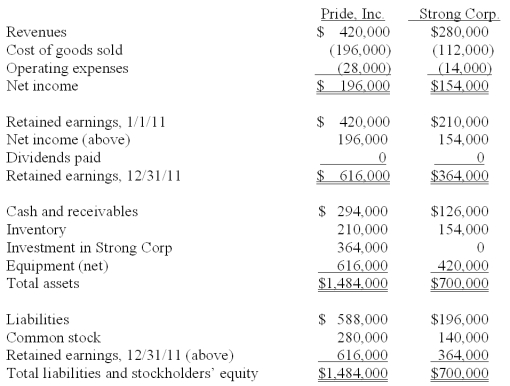

As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

-What is the consolidated total for inventory at December 31, 2011?

A) $336,000.

B) $280,000.

C) $364,000.

D) $347,200.

E) $349,300.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: For consolidation purposes, what amount would be

Q35: Strickland Company sells inventory to its parent,

Q37: The reported sales did not include any

Q38: For each of the following situations (1

Q43: Stiller Company, an 80% owned subsidiary of

Q44: What is the total of consolidated cost

Q44: Gargiulo Company, a 90% owned subsidiary

Q45: Compute consolidated cost of goods sold.<br>A) $7,500,000.<br>B)

Q90: Fraker, Inc. owns 90 percent of Richards,

Q93: When is the gain on an intra-entity