Essay

Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

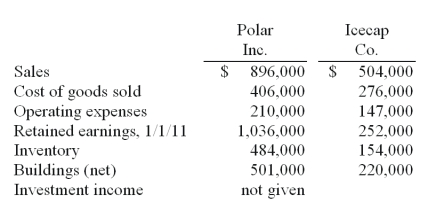

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:

-Polar sold a building to Icecap on January 1, 2010 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Buildings (net), (2) Operating expenses, and (3) Noncontrolling Interest in Subsidiary's Net Income.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Justings Co. owned 80% of Evana Corp.

Q54: Stark Company, a 90% owned subsidiary of

Q56: Stiller Company, an 80% owned subsidiary of

Q58: Walsh Company sells inventory to its subsidiary,

Q60: On January 1, 2011, Musial Corp. sold

Q61: Stark Company, a 90% owned subsidiary of

Q62: Strayten Corp. is a wholly owned subsidiary

Q72: An intra-entity sale took place whereby the

Q79: What is meant by unrealized inventory gains,

Q94: Gibson Corp. owned a 90% interest in