Multiple Choice

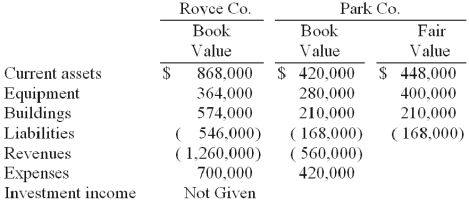

Royce Co. acquired 60% of Park Co. for $420,000 on December 31, 2010 when Park's book value was $560,000. The Royce stock was not actively traded. On the date of acquisition, Park had equipment (with a ten-year life) that was undervalued in the financial records by $140,000. One year later, the following selected figures were reported by the two companies. Additionally, no dividends have been paid.

-What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2011 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2011?

A) $56,000 and $280,000.

B) $50,400 and $218,400.

C) $56,000 and $224,000.

D) $56,000 and $336,000.

E) $50,400 and $330,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: When a parent uses the equity method

Q45: How would you determine the amount of

Q49: MacHeath Inc. bought 60% of the outstanding

Q75: When consolidating a subsidiary that was acquired

Q76: Which of the following statements is false

Q96: Pell Company acquires 80% of Demers

Q97: When Jolt Co. acquired 75% of the

Q99: On January 1, 2008, prior to the

Q102: Pell Company acquires 80% of Demers

Q103: Alonzo Co.acquired 60% of Beazley Corp.by paying