Essay

On January 1, 2011, John Doe Enterprises (JDE) acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.

On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2011. For internal reporting purposes, JDE employed the equity method to account for this investment.

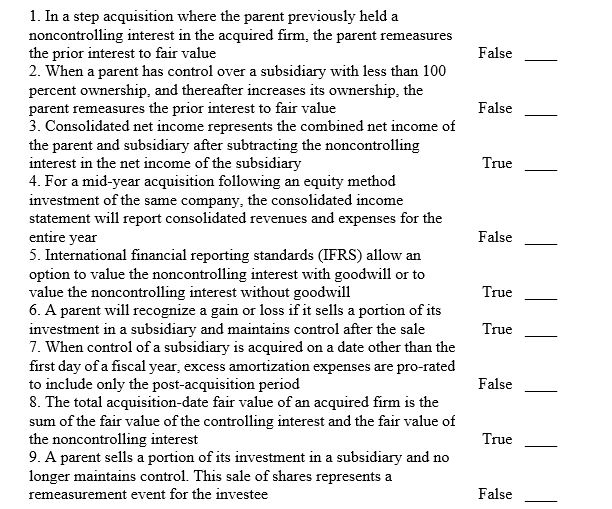

-Select True (T) or False (F) for each of the following statements:

Correct Answer:

Verified

Correct Answer:

Verified

Q4: All of the following statements regarding the

Q20: On January 1, 2010, Jannison Inc. acquired

Q22: Pell Company acquires 80% of Demers

Q23: On January 1, 2010, Jannison Inc.

Q24: McGuire company acquired 90 percent of

Q27: McGuire company acquired 90 percent of

Q29: Pell Company acquires 80% of Demers

Q30: Beta Corp. owns less than one hundred

Q69: When a parent uses the partial equity

Q108: Tosco Co. paid $540,000 for 80% of