Essay

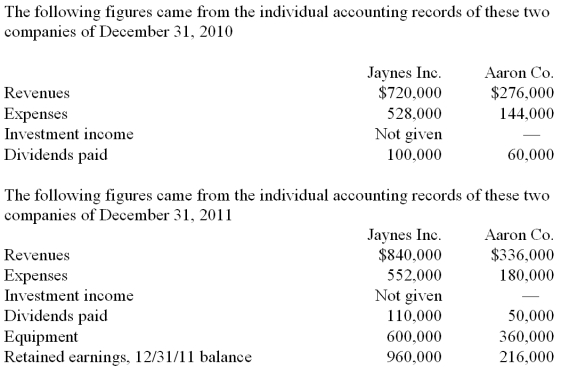

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2010, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

-What was consolidated equipment as of December 31, 2011?

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Yules Co. acquired Noel Co. in an

Q18: Avery Company acquires Billings Company in a

Q38: Under the initial value method, when accounting

Q51: Figure:<br>Perry Company acquires 100% of the stock

Q53: Figure:<br>On January 1, 2010, Cale Corp.

Q55: Beatty, Inc. acquires 100% of the voting

Q57: Cashen Co. paid $2,400,000 to acquire all

Q58: Figure:<br>On January 1, 2010, Cale Corp.

Q61: Kaye Company acquired 100% of Fiore Company

Q73: Which of the following will result in