Multiple Choice

Figure:

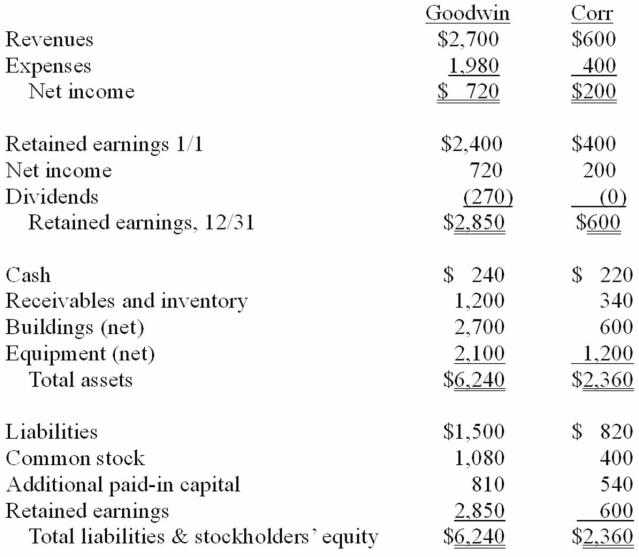

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consideration transferred for this acquisition at December 31, 20X1.

A) $900.

B) $1,165.

C) $1,200.

D) $1,765.

E) $1,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: How is contingent consideration accounted for in

Q6: Prepare the journal entries to record: (1)

Q12: Compute consolidated goodwill at the date of

Q27: Compute consolidated equipment (net) at the date

Q95: An example of a difference in types

Q96: Figure:<br>Presented below are the financial balances for

Q97: Figure:<br>Presented below are the financial balances for

Q98: Figure:<br>The financial statements for Goodwin, Inc., and

Q104: The following are preliminary financial statements for

Q105: Figure:<br>Presented below are the financial balances for