Essay

Figure:

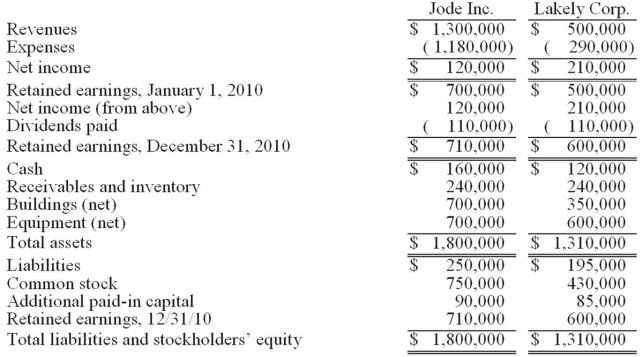

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2010, follow. Lakely's buildings were undervalued on its financial records by $60,000.  On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fairvalue on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

On December 31, 2010, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fairvalue on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

-Determine consolidated net income for the year ended December 31, 2010.

Correct Answer:

Verified

Note: The subsidiary's revenu...

Note: The subsidiary's revenu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Bale Co. acquired Silo Inc. on December

Q15: Which of the following statements is true?<br>A)

Q19: Figure:<br>The financial statements for Goodwin, Inc., and

Q25: Figure:<br>Presented below are the financial balances for

Q27: Figure:<br>Flynn acquires 100 percent of the outstanding

Q75: Compute consolidated land at the date of

Q84: Compute fair value of the net assets

Q95: Describe the accounting for direct costs, indirect

Q99: Compute consolidated long-term liabilities at the date

Q99: Peterman Co. owns 55% of Samson Co.