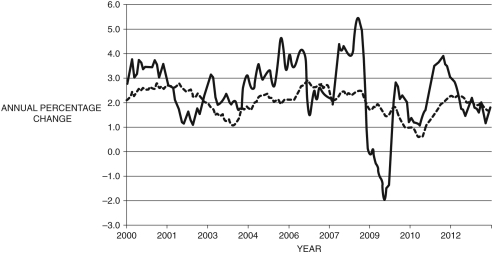

Figure 103: (Source: Federal Reserve Economic Data, St A) What Is the Bank's Net Worth?

B) If the Federal

Essay

Figure 10.3:  (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Consider the hypothetical bank balance sheet below to answer the following questions.

Table 10.3: Hypothetical Bank Sheet ($ millions)

A) What is the bank's net worth?

B) If the reserve requirement is 5 percent, what is the amount of "excess reserves" held by this bank?

C) What is this bank's leverage ratio?

D) If the bank's investments fall by $1,000, what is the bank's equity? Leverage ratio?

Correct Answer:

Verified

a. Net worth = Assets - Liabilities = $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Briefly discuss the macroeconomic outcomes of the

Q16: A salve to the wounds of the

Q22: When a bank's assets cannot cover its

Q25: Unemployment in the Great Recession peaked at

Q45: What is the fed funds rate?<br>A) interest

Q45: What is an indicator of the extent

Q46: The following table shows real GDP

Q73: The sharp swing in core inflation in

Q88: In _, housing prices collapsed following a

Q107: Which country did NOT experience a financial