Multiple Choice

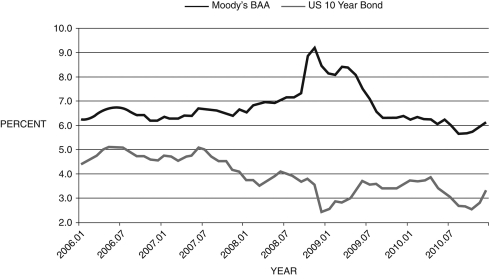

The following figure shows the BAA corporate and 10-Year Treasury Bond yields. Refer to this figure when answering

Figure 14.1: BAA and 10-Year Bonds, 2006-2010

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Consider Figure 14.1 above. The difference between these two curves can be interpreted as:

A) the financial friction

B) inflation expectations

C) the risk-free rate

D) a market imperfection

E) the prime lending rate

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The March 20, 2013, Federal Open Market

Q57: The European debt crisis hit all of

Q83: Figure 14.1: BAA and 10-Year Bonds, 2006-2010

Q88: The federal budget deficit _ in 2009

Q89: The effect of the subprime loan crisis

Q91: The burst of the housing bubble

Q92: The return to a risky asset

Q94: Which of the following financial reforms were

Q95: The difference between the 3-month bond yield

Q97: In the aftermath of the recent financial