Essay

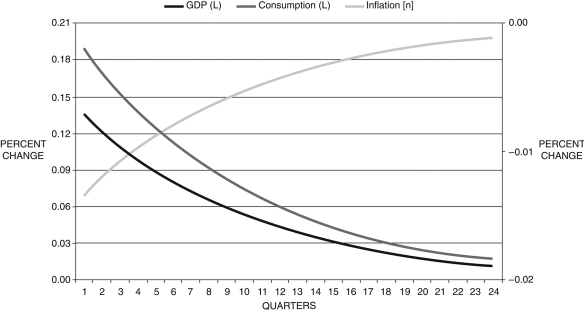

A new colleague of yours decided to try her hand at DSGE models and found some computer code that allows her to run a version of the Smets-Wouters DSGE model. She decides to try a contractionary monetary shock. When she does, she gets the following impulse response function for real GDP (left scale), consumption (left), and inflation (right). When she shows you her results you are immediately skeptical based on what you know about economic theory and impulse response functions. Explain your skepticism.

Figure 15.5

Impulse response functions

Correct Answer:

Verified

First, you note that with contractionary...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: In the business cycle literature, a better

Q66: When taxes are included in the labor

Q68: When taxes are included in the

Q71: With sticky prices, in the stylized DSGE

Q74: With sticky nominal wages a monetary expansion

Q75: Refer to the following figure when

Q77: In the Smets-Wouters DSGE model, the

Q79: The early DSGE models assumed that TFP:<br>A)

Q87: In the impulse response function presented in

Q92: In the simplified DSGE model in the