Essay

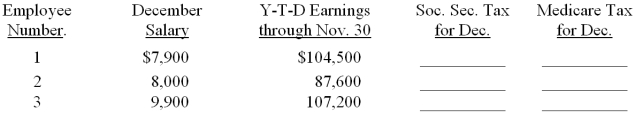

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Barbara's Bookstore, Inc. are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate and a base of $106,800 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No. 1: Soc. Sec. Tax,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Withholding for federal income taxes places employees

Q33: During the week ended January 11, 2013,

Q35: The column totals in a payroll register<br>A)

Q36: The monthly salaries for December and the

Q39: Match the accounting terms with the description

Q40: Earnings in excess of the social security

Q41: Rick O'Shea, the only employee of Hunter

Q43: Salespeople who are paid a percentage of

Q66: Jill Monroe earns $25 per hour.She worked

Q75: An independent _ is paid by the