Essay

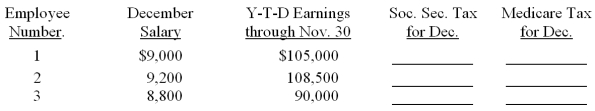

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of Heather's Hair Salon are listed below. Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December. Assume a 6.2 percent social security tax rate and a base of $106,800 for the calendar year. Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No. 1: Soc. Sec. Tax,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: After payroll computations are made, the hours

Q24: FICA tax is commonly referred to as

Q30: An employee whose regular hourly rate is

Q47: Employers are required to pay workers' _

Q51: Which of the following statements is correct?<br>A)

Q63: The gross pay of an hourly employee

Q67: The Burns Company has two office employees

Q68: For which of the following taxes is

Q70: The Royal Company has office employees and

Q74: The employer records the amount of federal