Essay

Adjustments and closing process-basic entries

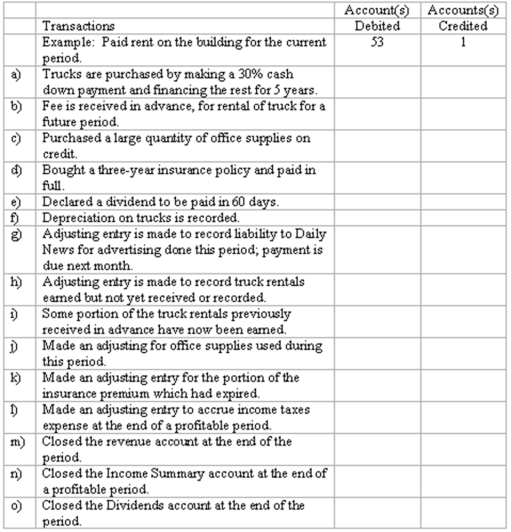

Selected ledger accounts used by Speedy Truck Rentals Limited, are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Income summary does not appear on the

Q16: Which of the following items should not

Q20: Closing entries<br>An Adjusted Trial Balance for

Q22: Refer to the above data. The entry

Q23: Which of the following accounts will be

Q24: Refer to the above data. Income Summary

Q42: In regard to disclosures that are required

Q79: The purpose of making closing entries is

Q85: The current ratio equals current assets plus

Q121: Closing entries do not affect the cash