Essay

Journalize and post basic transactions

Precision Grading Co. was organized to grade construction sites.

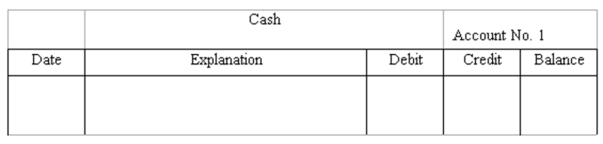

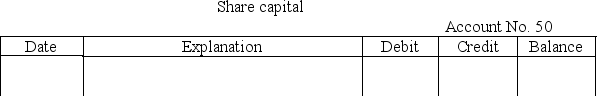

* On June 1, owner Dave Precision deposited $90,000 in a new bank account opened in the name of the business in exchange for stock.

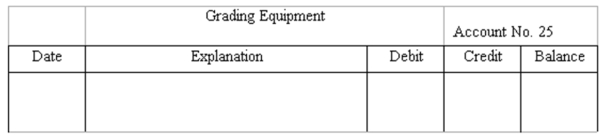

* On June 3, the company acquired grading equipment costing $89,000, paying $43,000 cash and signing a note payable for the balance.

* On June 10, the company paid $13,000 of the amount owed for equipment acquired on June 3.

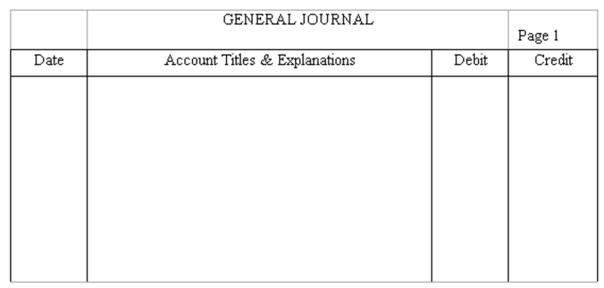

Instructions: Journalize these three transactions and post to the ledger accounts.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The matching principle:<br>A)Applies only to situations in

Q40: In accounting,the terms debit and credit indicate,respectively:<br>A)Increase

Q64: When making a general journal entry,there can

Q69: Transactions are recorded in the general journal

Q110: A trial balance that is out of

Q113: The matching concept refers to the relationship

Q116: When a company uses the double-entry method,

Q120: Which of the following accounts normally does

Q121: Revenues increase equity and are, therefore, recorded

Q122: The reason that both expenses and dividends