Essay

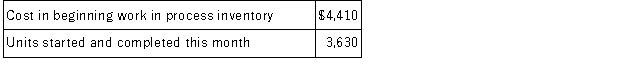

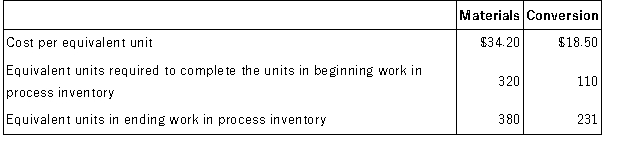

Mottai Corporation uses the FIFO method in its process costing system. The following data concern the company's Assembly Department for the month of August.

Required:

Required:

Determine the cost of ending work in process inventory and the cost of units transferred out of the department during August using the FIFO method.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Easy Inc. uses the FIFO method in

Q10: Carson Corporation uses the FIFO method in

Q13: Marlan Manufacturing produces a product that passes

Q15: Higgins Labs Inc., uses a process costing

Q16: The following information was obtained from the

Q17: Toefield Corporation uses the FIFO method in

Q18: Muzyka Corporation uses the FIFO method in

Q19: Laurie Corporation uses the FIFO method in

Q42: There is no difference in the unit

Q48: If the FIFO cost method is used