Essay

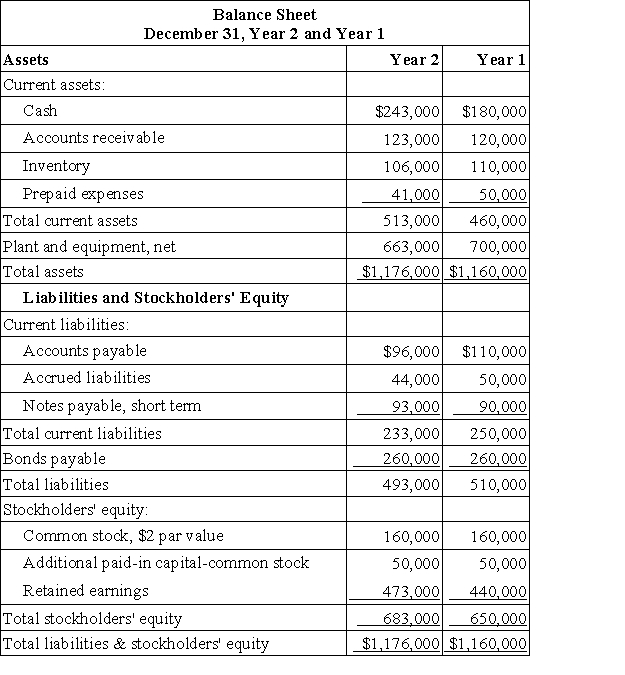

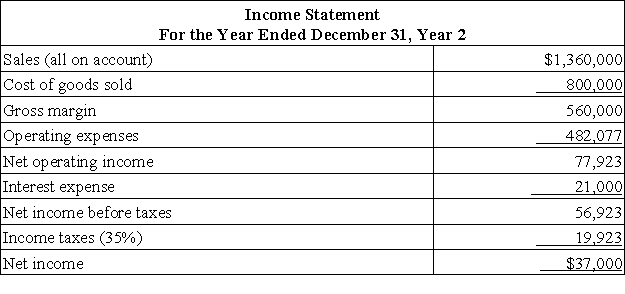

Kisselburg Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Dividends on common stock during Year 2 totaled $4,000. The market price of common stock at the end of Year 2 was $5.75 per share.

Required:

a. What is the company's working capital at the end of Year 2?

b. What is the company's current ratio at the end of Year 2?

c. What is the company's acid-test (quick) ratio at the end of Year 2?

d. What is the company's accounts receivable turnover for Year 2?

e. What is the company's average collection period (age of receivables) for Year 2?

f. What is the company's inventory turnover for Year 2?

g. What is the company's average sale period (turnover in days) for Year 2?

h. What is the company's operating cycle for Year 2?

i. What is the company's total asset turnover for Year 2?

j. What is the company's times interest earned for Year 2?

k. What is the company's debt-to-equity ratio at the end of Year 2?

l. What is the company's equity multiplier at the end of Year 2?

m. What is the company's net profit margin percentage for Year 2?

n. What is the company's gross margin percentage for Year 2?

o. What is the company's return on total assets for Year 2?

p. What is the company's return on equity for Year 2?

q. What is the company's earnings per share for Year 2?

r. What is the company's price-earnings ratio for Year 2?

s. What is the company's dividend payout ratio for Year 2?

t. What is the company's dividend yield ratio for Year 2?

u. What is the company's book value per share at the end of Year 2?

Correct Answer:

Verified

a. Working capital = Current assets - Cu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Symons Corporation has provided the following financial

Q9: Excerpts from Sydner Corporation's most recent balance

Q10: Nickolls Corporation has provided the following financial

Q11: Gambino Corporation has provided the following financial

Q15: Mahoe Corporation has provided the following financial

Q16: Data from Yochem Corporation's most recent balance

Q17: Data from Estrin Corporation's most recent

Q30: Dratif Corporation's working capital is $33,000 and

Q32: The formula for the return on equity

Q53: Sabino Corporation's total common stock was $500,000