Multiple Choice

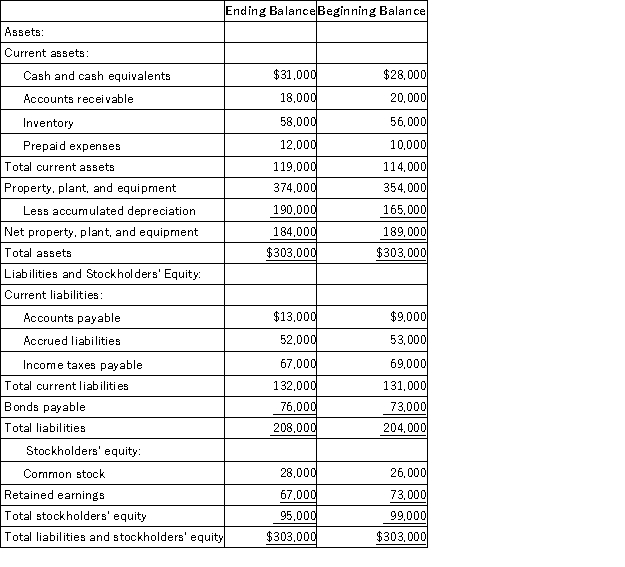

Krech Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities. Which of the following is correct regarding the operating activities section of the statement of cash flows?

A) The change in Prepaid Expenses will be added to net income; The change in Income Taxes Payable will be subtracted from net income

B) The change in Prepaid Expenses will be subtracted from net income; The change in Income Taxes Payable will be subtracted from net income

C) The change in Prepaid Expenses will be subtracted from net income; The change in Income Taxes Payable will be added to net income

D) The change in Prepaid Expenses will be added to net income; The change in Income Taxes Payable will be added to net income

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The following transactions occurred last year at

Q34: Buckley Corporation's most recent comparative balance sheet

Q35: Megan Corporation's net income last year was

Q36: Beltram Corporation's balance sheet and income statement

Q38: The Warrel Corporation reported the following data

Q40: Autry Corporation's balance sheet and income statement

Q41: Hirshberg Corporation's comparative balance sheet appears below:

Q57: Furis Corporation's cash and cash equivalents consist

Q87: Investing activities on the statement of cash

Q208: An increase in accounts receivable of $1,000