Multiple Choice

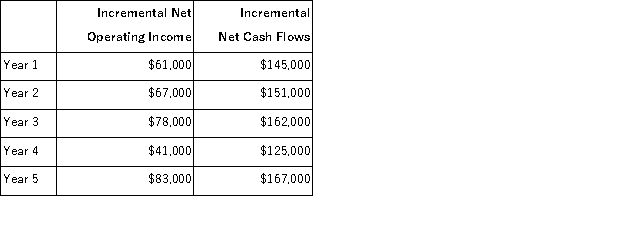

Baldock Inc. is considering the acquisition of a new machine that costs $420,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are:  Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to:

A) 5.0 years

B) 3.2 years

C) 1.9 years

D) 2.8 years

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The management of Cantell Corporation is considering

Q26: The management of Moya Corporation is investigating

Q27: Pro-Mate, Inc. is a producer of athletic

Q28: Flamio Corporation is considering a project that

Q29: Alesi Corporation is considering purchasing a machine

Q33: The Sawyer Corporation has $80,000 to invest

Q35: Carlson Manufacturing has some equipment that needs

Q45: In the payback method, depreciation is deducted

Q140: Discounted cash flow techniques do not take

Q157: Bevans Corporation is considering a capital budgeting