Multiple Choice

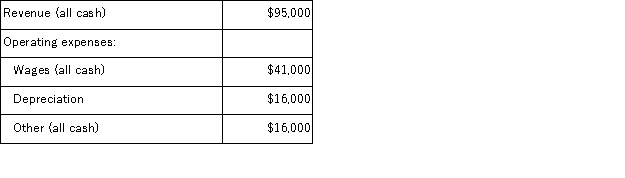

The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000. The equipment would have a useful life of six years, with a salvage value of $29,000. This new equipment would be depreciated over its useful life by the straight-line method. It would replace existing equipment which is fully depreciated. The existing equipment has a salvage value now of $38,000. The anticipated annual revenues and expenses associated with the new equipment are:  Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. For this investment, the simple rate of return to the nearest tenth of a percent is:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. For this investment, the simple rate of return to the nearest tenth of a percent is:

A) 43.7%

B) 25.3%

C) 30.4%

D) 17.6%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The following data concern an investment project:

Q15: Frick Road Paving Corporation is considering an

Q19: Baldock Inc. is considering the acquisition of

Q21: The project profitability index is computed by

Q21: Chee Corporation has gathered the following data

Q23: Bullinger Corporation has provided the following data

Q53: The project profitability index is used to

Q103: The investment required for the project profitability

Q122: In preference decision situations, a project with

Q151: The required rate of return is the