Multiple Choice

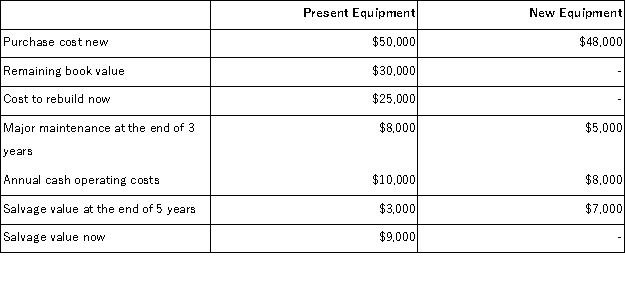

Carlson Manufacturing has some equipment that needs to be rebuilt or replaced. The following information has been gathered relative to this decision:  Carlson uses the total cost approach to net present value analysis and a discount rate of 12%. Regardless of which option is chosen, rebuild or replace, at the end of five years Carlson Manufacturing will have no future use for the equipment. If the new equipment is purchased, the present value of the annual cash operating costs associated with this alternative is:

Carlson uses the total cost approach to net present value analysis and a discount rate of 12%. Regardless of which option is chosen, rebuild or replace, at the end of five years Carlson Manufacturing will have no future use for the equipment. If the new equipment is purchased, the present value of the annual cash operating costs associated with this alternative is:

A) ($28,840)

B) ($19,160)

C) ($14,420)

D) ($36,050)

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Preference decisions follow screening decisions and seek

Q43: When considering a number of investment projects,

Q94: Consider the following three investment opportunities:<br>Project I

Q97: The management of Basler Corporation is considering

Q98: Baker Corporation is considering buying a new

Q100: Pro-Mate, Inc. is a producer of athletic

Q101: Mercer Corporation is considering replacing a technologically

Q102: Tangen Corporation is considering the purchase of

Q103: Bill Anders retires in 5 years. He

Q104: Beaver Corporation is investigating the purchase of