Multiple Choice

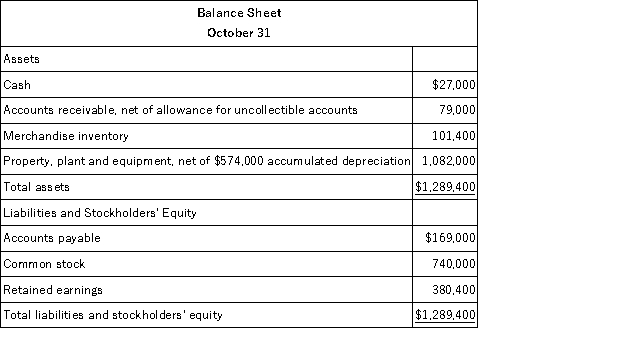

Dilbert Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: o Sales are budgeted at $260,000 for November, $230,000 for December, and $210,000 for January.

O Collections are expected to be 80% in the month of sale, 19% in the month following the sale, and 1% uncollectible.

O The cost of goods sold is 65% of sales.

O The company desires to have an ending merchandise inventory at the end of each month equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

O Other monthly expenses to be paid in cash are $20,300.

O Monthly depreciation is $20,000.

O Ignore taxes.  The cost of December merchandise purchases would be:

The cost of December merchandise purchases would be:

A) $141,700

B) $169,000

C) $81,900

D) $149,500

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Morrish Inc. bases its manufacturing overhead budget

Q54: Cowles Corporation Inc., makes and sells a

Q56: Noel Enterprises has budgeted sales in units

Q57: Morie Corporation is working on its direct

Q58: The following are budgeted data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2460/.jpg"

Q63: Two yards of a fabric are required

Q64: LFM Corporation makes and sells a product

Q74: A benefit of self-imposed budgeting is that

Q157: The direct labor budget is based on:<br>A)the

Q165: The manufacturing overhead budget lists all costs