Essay

Weldon Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow:

o Sales are budgeted at $360,000 for November, $380,000 for December, and $350,000 for January.

o Collections are expected to be 75% in the month of sale, 20% in the month following the sale, and 5% uncollectible.

o The cost of goods sold is 65% of sales.

o The company desires an ending merchandise inventory equal to 60% of the cost of goods sold in the following month.

o Payment for merchandise is made in the month following the purchase.

o Other monthly expenses to be paid in cash are $21,900.

o Monthly depreciation is $20,000.

o Ignore taxes.  Required:

Required:

a. Prepare a Schedule of Expected Cash Collections for November and December.

b. Prepare a Merchandise Purchases Budget for November and December.

c. Prepare Cash Budgets for November and December.

d. Prepare Budgeted Income Statements for November and December.

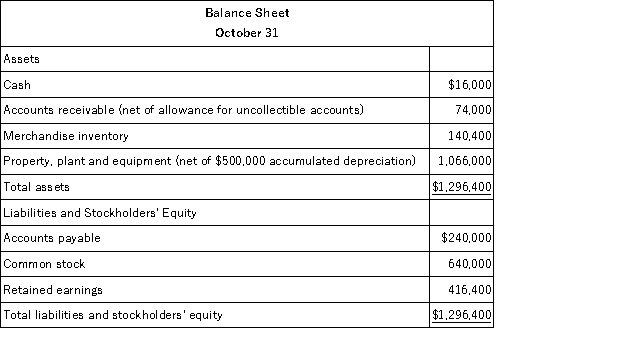

e. Prepare a Budgeted Balance Sheet for the end of December.

Correct Answer:

Verified

Correct Answer:

Verified

Q64: LFM Corporation makes and sells a product

Q65: The following are budgeted data for the

Q66: Rogers Corporation is preparing its cash budget

Q67: Adi Manufacturing Corporation is estimating the following

Q68: Carter Lumber sells lumber and general building

Q71: The direct labor budget of Faier Corporation

Q73: G Products Inc., manufactures garlic gravy. G's

Q74: The Adams Corporation, a merchandising firm, has

Q94: Which of the following is NOT an

Q162: The budget method that maintains a constant