Multiple Choice

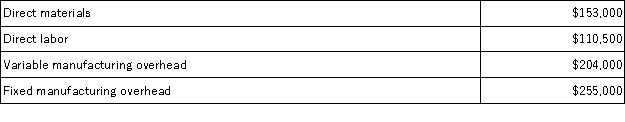

Harris Corporation produces a single product. Last year, Harris manufactured 17,000 units and sold 13,000 units. Production costs for the year were as follows:  Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost. Under absorption costing, the ending inventory for the year would be valued at:

Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labor is a variable cost. Under absorption costing, the ending inventory for the year would be valued at:

A) $190,800

B) $170,000

C) $230,800

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q55: If a company operates at the break

Q92: Minick Corporation has two divisions: Grocery Division

Q93: The Dean Corporation produces and sells a

Q96: Carrejo Corporation has two divisions: Division M

Q97: Peterson Corporation produces a single product. Data

Q98: Higgins Corporation sells three products, Product A,

Q99: Criblez Corporation has two divisions: Blue Division

Q213: The term gross margin is used in

Q222: Under variable costing, variable production costs are

Q226: Sechrest Corporation manufactures a single product. Last