Multiple Choice

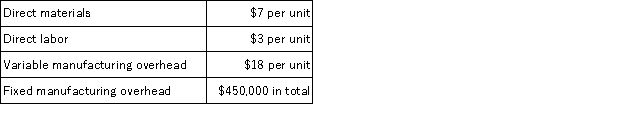

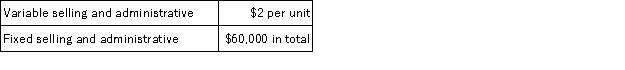

During its first year of operations, Carlos Manufacturing Corporation incurred the following costs to produce 8,000 units of its only product:  The company also incurred the following costs in selling 7,500 units of product during its first year:

The company also incurred the following costs in selling 7,500 units of product during its first year:  Assume that direct labor is a variable cost. Under absorption costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Assume that direct labor is a variable cost. Under absorption costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

A) $15,000

B) $42,125

C) $44,000

D) $47,125

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Under variable costing, product costs consist of

Q75: When using data from a segmented income

Q180: Meyer Corporation has two sales areas: North

Q181: Peterson Corporation produces a single product. Data

Q182: Martz Corporation manufactures a single product. The

Q183: Lasorsa Corporation manufactures a single product. Variable

Q184: Mahugh Corporation, which has only one product,

Q186: Crossbow Corp. produces a single product. Data

Q188: A manufacturing company that produces a single

Q190: Cutterski Corporation manufactures a propeller. Shown below