Essay

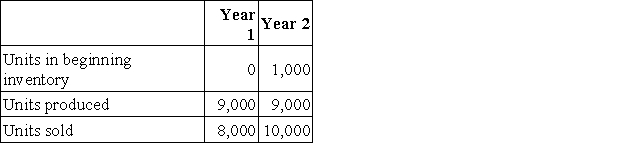

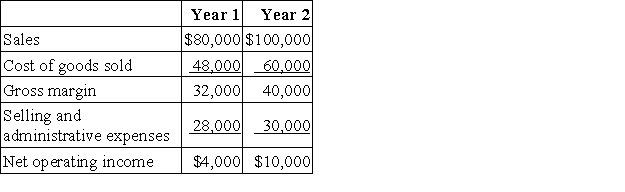

Hanks Corporation produces a single product. Operating data for the company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead was $18,000 in each year. This fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold.

Required:

a. Compute the unit product cost in each year under variable costing.

b. Prepare new income statements for each year using variable costing.

c. Reconcile the absorption costing and variable costing net operating income for each year.

Correct Answer:

Verified

a. The unit product cost under variable ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: Monce Corporation has two divisions: Home Division

Q120: Elliot Corporation, which has only one product,

Q121: Kosco Corporation produces a single product. The

Q122: Aaker Corporation, which has only one product,

Q123: Ragins Corporation produces a single product and

Q125: Harris Corporation produces a single product. Last

Q126: Zimmerli Corporation manufactures a single product. The

Q128: A manufacturing company that produces a single

Q129: Criblez Corporation has two divisions: Blue Division

Q221: A company produces a single product. Variable