Multiple Choice

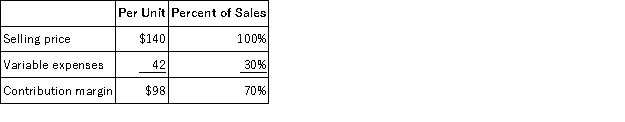

Hartung Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $16,800

B) increase of $226,000

C) increase of $30,000

D) decrease of $14,000

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Incremental analysis is generally the most complicated

Q47: Comings Corporation produces and sells two products.

Q48: On a cost-volume-profit graph, the revenue line

Q75: Mcallister Corporation has provided the following data

Q76: Ofarrell Corporation, a company that produces and

Q81: Callicott Corporation produces a product that sells

Q83: Solen Corporation's break-even-point in sales is $900,000,

Q85: Data concerning Cutshall Enterprises Corporation's single product

Q102: Which of the following is NOT a

Q161: In two companies making the same product