Multiple Choice

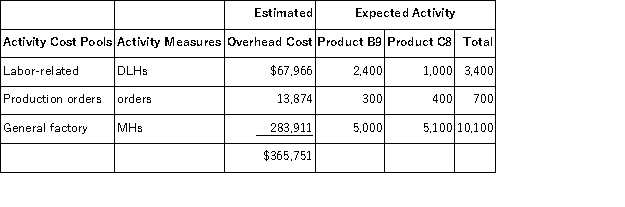

Olide, Inc., manufactures and sells two products: Product B9 and Product C8. The annual production and sales of Product of B9 is 300 units and of Product C8 is 100 units. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product C8 under activity-based costing is closest to:

The overhead applied to each unit of Product C8 under activity-based costing is closest to:

A) $1,433.61 per unit

B) $1,712.79 per unit

C) $1,075.70 per unit

D) $914.38 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Facility-level costs can be traced on a

Q5: Diemer, Inc., manufactures and sells two products:

Q6: Jeanlouis, Inc., manufactures and sells two products:

Q8: Accurso, Inc., manufactures and sells two products:

Q10: When a company changes from a traditional

Q11: Activity rates in activity-based costing are computed

Q12: Garhart Corporation uses the following activity rates

Q13: Serva, Inc., manufactures and sells two products:

Q14: Setting up a machine to change from

Q21: Assembling a product is an example of