Multiple Choice

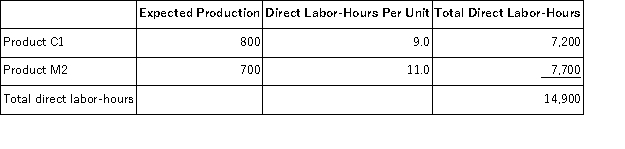

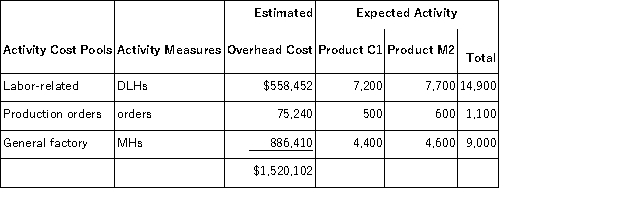

Machuga, Inc., manufactures and sells two products: Product C1 and Product M2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH. The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $18.70 per DLH. The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product C1 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product C1 would be closest to:

A) $337.32 per unit

B) $615.60 per unit

C) $918.18 per unit

D) $886.41 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q117: Abbe, Inc., manufactures and sells two products:

Q118: Frogge, Inc., manufactures and sells two products:

Q119: Tesh, Inc., manufactures and sells two products:

Q120: Swimm Company allocates materials handling cost to

Q121: Lamon, Inc., manufactures and sells two products:

Q123: Drucker, Inc., manufactures and sells two products:

Q124: Minon, Inc., manufactures and sells two products:

Q125: Hane Corporation uses the following activity rates

Q126: Companies use three common approaches to assign

Q127: Dunnivan, Inc., manufactures and sells two products: