Multiple Choice

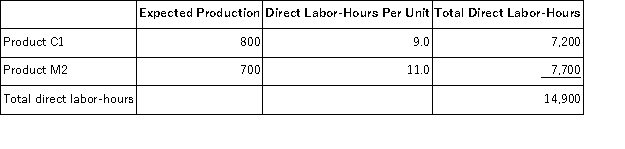

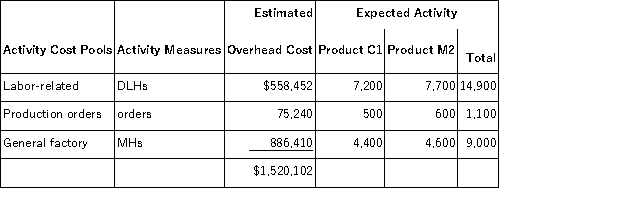

Machuga, Inc., manufactures and sells two products: Product C1 and Product M2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.70 per DLH. The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $18.70 per DLH. The direct materials cost per unit is $297.00 for Product C1 and $246.20 for Product M2. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product M2 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product M2 would be closest to:

A) $752.40 per unit

B) $412.28 per unit

C) $1,122.22 per unit

D) $1,083.39 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q140: Pachero, Inc., manufactures and sells two products:

Q141: Fullard, Inc., manufactures and sells two products:

Q142: Adams Company has two products: A andB.

Q143: Luckado, Inc., manufactures and sells two products:

Q144: Masiclat, Inc., manufactures and sells two products:

Q146: Bolerjack, Inc., manufactures and sells two products:

Q147: Testing a prototype of a new product

Q148: Minon, Inc., manufactures and sells two products:

Q149: Gould Corporation uses the following activity rates

Q150: Nakayama, Inc., manufactures and sells two products: