Multiple Choice

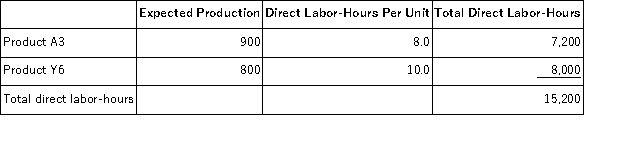

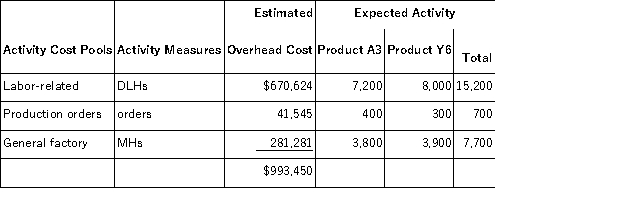

Mellencamp, Inc., manufactures and sells two products: Product A3 and Product Y6. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.20 per DLH. The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The direct labor rate is $24.20 per DLH. The direct materials cost per unit is $146.60 for Product A3 and $256.20 for Product Y6. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The unit product cost of Product A3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

The unit product cost of Product A3 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

A) $632.44 per unit

B) $693.16 per unit

C) $815.00 per unit

D) $863.08 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q170: Schoeninger, Inc., manufactures and sells two products:

Q171: Betenbaugh, Inc., manufactures and sells two products:

Q172: Serva, Inc., manufactures and sells two products:

Q173: Batch-level activities are performed each time a

Q174: Angara Corporation uses activity-based costing to determine

Q176: Betenbaugh, Inc., manufactures and sells two products:

Q177: Serva, Inc., manufactures and sells two products:

Q178: Scarff, Inc., manufactures and sells two products:

Q179: In activity-based costing, unit product costs computed

Q180: Meiler, Inc., manufactures and sells two products: