Essay

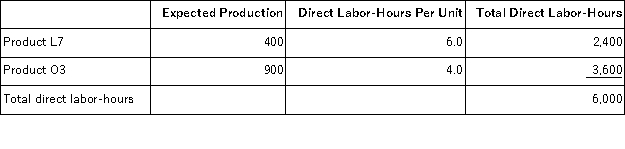

Trezise, Inc., manufactures and sells two products: Product L7 and Product O3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $15.60 per DLH. The direct materials cost per unit is $257.70 for Product L7 and $288.30 for Product O3.

The direct labor rate is $15.60 per DLH. The direct materials cost per unit is $257.70 for Product L7 and $288.30 for Product O3.

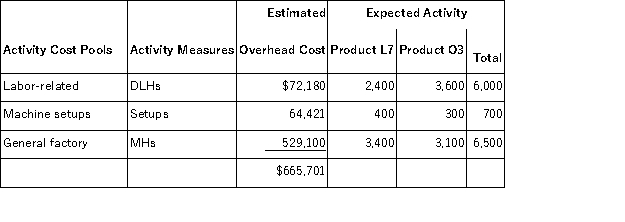

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

a. Computation of activity rat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q179: In activity-based costing, unit product costs computed

Q180: Meiler, Inc., manufactures and sells two products:

Q181: Lystra Corporation manufactures two products, Product B

Q182: Mellencamp, Inc., manufactures and sells two products:

Q183: Pachero, Inc., manufactures and sells two products:

Q185: In the second-stage allocation in activity-based costing,

Q186: In activity-based costing, unit product costs computed

Q187: An activity measure in activity-based costing expresses

Q188: The plant manager's work is an example

Q189: Angara Corporation uses activity-based costing to determine