Essay

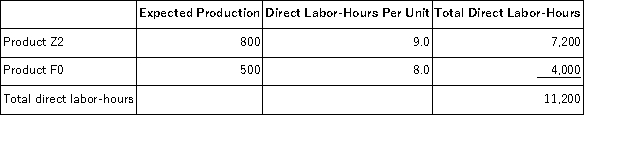

Stirman, Inc., manufactures and sells two products: Product Z2 and Product F0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $28.60 per DLH. The direct materials cost per unit for each product is given below:

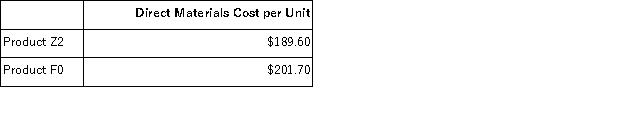

The direct labor rate is $28.60 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

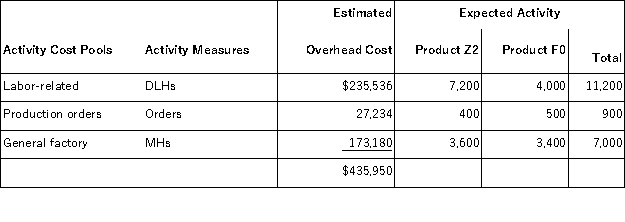

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

Computation of activity rates:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Garhart Corporation uses the following activity rates

Q13: Serva, Inc., manufactures and sells two products:

Q14: Setting up a machine to change from

Q15: Boutet, Inc., manufactures and sells two products:

Q16: Which of the following would be classified

Q18: Minon, Inc., manufactures and sells two products:

Q20: Bolerjack, Inc., manufactures and sells two products:

Q21: Punches, Inc., manufactures and sells two products:

Q22: Overmeyer, Inc., manufactures and sells two products:

Q188: Which of the following would be classified