Essay

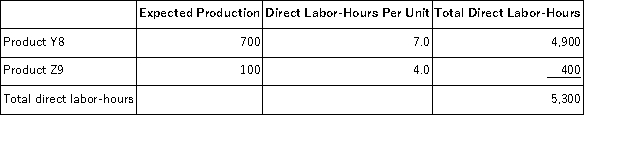

Moul, Inc., manufactures and sells two products: Product Y8 and Product Z9. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.80 per DLH. The direct materials cost per unit is $116.30 for Product Y8 and $187.40 for Product Z9.

The direct labor rate is $18.80 per DLH. The direct materials cost per unit is $116.30 for Product Y8 and $187.40 for Product Z9.

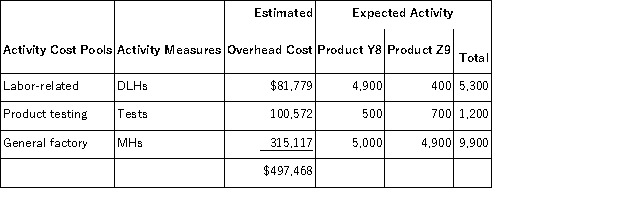

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

Computation of activity rates:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q194: Finken, Inc., manufactures and sells two products:

Q195: Villeda Corporation uses the following activity rates

Q196: Marchan, Inc., manufactures and sells two products:

Q197: Filosa, Inc., manufactures and sells two products:

Q198: Neldon, Inc., manufactures and sells two products:

Q200: Betenbaugh, Inc., manufactures and sells two products:

Q201: Activity-based costing involves a two-stage allocation process

Q202: Brenneis, Inc., manufactures and sells two products:

Q203: Would the following activities at a manufacturer

Q204: Cassano, Inc., manufactures and sells two products: