Essay

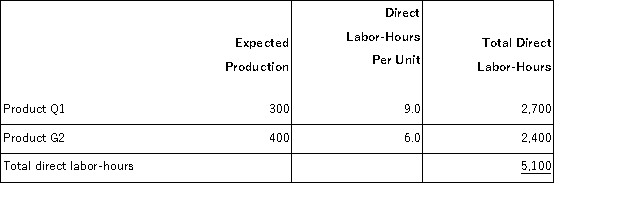

Rosman, Inc., manufactures and sells two products: Product Q1 and Product G2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $23.80 per DLH. The direct materials cost per unit for each product is given below:

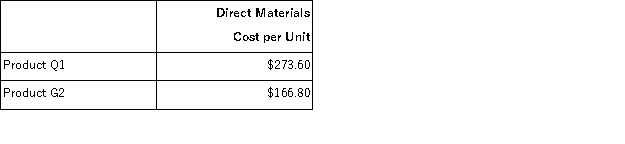

The direct labor rate is $23.80 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

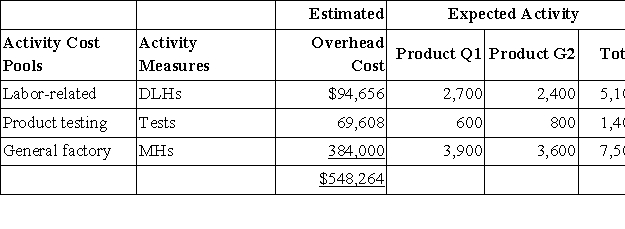

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Correct Answer:

Verified

Predetermined overhead rate = Estimated ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Penegar, Inc., manufactures and sells two products:

Q62: All other things the same, the unit

Q63: Mcleese, Inc., manufactures and sells two products:

Q64: Penegar, Inc., manufactures and sells two products:

Q65: Aboud, Inc., manufactures and sells two products:

Q67: Boahn, Inc., manufactures and sells two products:

Q68: Serva, Inc., manufactures and sells two products:

Q69: Hewett, Inc., manufactures and sells two products:

Q70: Crazier, Inc., manufactures and sells two

Q71: Accurso, Inc., manufactures and sells two products: