Essay

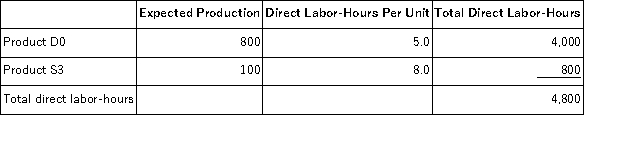

Besser, Inc., manufactures and sells two products: Product D0 and Product S3. Data concerning the expected production of each product and the  The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:

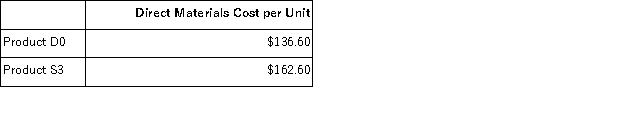

The direct labor rate is $24.70 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

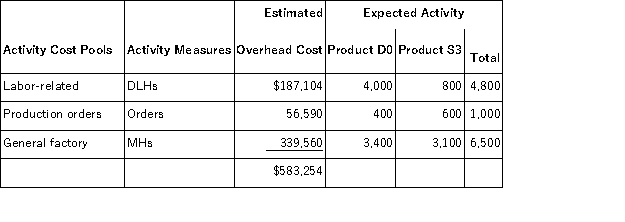

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method.

b. How much overhead would be applied to each product under the company's traditional costing method?

c. Determine the unit product cost of each product under the company's traditional costing method.

d. Compute the activity rates under the activity-based costing system.

e. Determine how much overhead would be assigned to each product under the activity-based costing system.

f. Determine the unit product cost of each product under the activity-based costing method.

g. What is the difference between the overhead per unit under the traditional costing method and the activity-based costing system for each of the two products?

h. What is the difference between the unit product costs under the under the traditional costing method and the activity-based costing system for each of the two products?

Correct Answer:

Verified

a. Predetermined overhead rate = Estimat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Activities consume resources. In activity-based costing an

Q85: Mellencamp, Inc., manufactures and sells two products:

Q86: Data concerning three of the activity cost

Q87: Mcleese, Inc., manufactures and sells two products:

Q88: Randolph, Inc., manufactures and sells two products:

Q90: Dobles Corporation has provided the following data

Q91: Frogge, Inc., manufactures and sells two products:

Q92: Betenbaugh, Inc., manufactures and sells two products:

Q93: Molinas, Inc., manufactures and sells two products:

Q94: Sylvest, Inc., manufactures and sells two products: