Multiple Choice

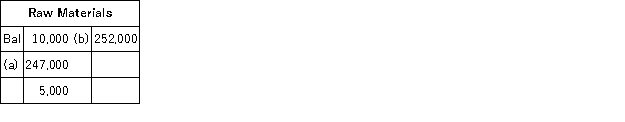

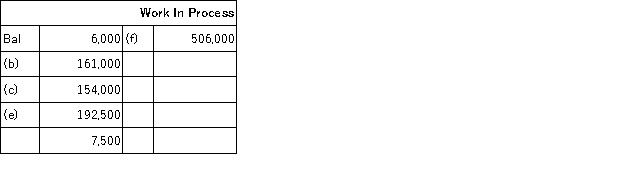

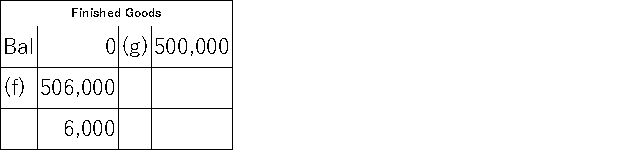

The following T-accounts have been constructed from last year's records at C&C Manufacturing:

C&C Manufacturing uses job-order costing with a predetermined overhead rate and applies manufacturing overhead to jobs based on direct labor costs. What is the predetermined overhead rate?

C&C Manufacturing uses job-order costing with a predetermined overhead rate and applies manufacturing overhead to jobs based on direct labor costs. What is the predetermined overhead rate?

A) 125%

B) 120%

C) 100%

D) 105%

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Dagger Corporation uses direct labor-hours in its

Q96: During May at Shatswell Corporation, $57,000 of

Q133: The following partially completed T-accounts summarize transactions

Q136: Meyers Corporation had the following inventory balances

Q137: Schoff Corporation has provided the following data

Q139: Dillon Corporation applies manufacturing overhead to jobs

Q142: Pirkl Corporation has provided the following data

Q144: When a job is completed, the goods

Q150: Manufacturing overhead is overapplied if actual manufacturing

Q166: The cost of a completed job in