Multiple Choice

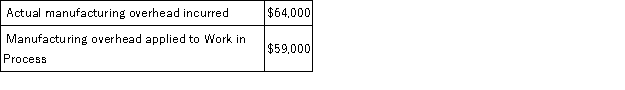

Smallwood Corporation has provided the following data concerning manufacturing overhead for January:  The Corporation's Cost of Goods Sold was $223,000 prior to closing out its Manufacturing Overhead account. The Corporation closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

The Corporation's Cost of Goods Sold was $223,000 prior to closing out its Manufacturing Overhead account. The Corporation closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

A) Manufacturing overhead for the month was overapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $228,000

B) Manufacturing overhead for the month was underapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $218,000

C) Manufacturing overhead for the month was underapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $228,000

D) Manufacturing overhead for the month was overapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $218,000

Correct Answer:

Verified

Correct Answer:

Verified

Q15: On the Schedule of Cost of Goods

Q36: During October, Beidleman Inc. transferred $52,000 from

Q49: Parsons Corporation uses a predetermined overhead rate

Q96: Dillon Corporation applies manufacturing overhead to jobs

Q99: On August 1, Shead Corporation had $35,000

Q102: Aksamit Corporation bases its predetermined overhead rate

Q103: Sigel Corporation bases its predetermined overhead rate

Q103: Chelm Music Corporation manufactures violins, violas, cellos,

Q120: The actual manufacturing overhead incurred at Fraze

Q160: Alden Company recorded the following transactions for