Multiple Choice

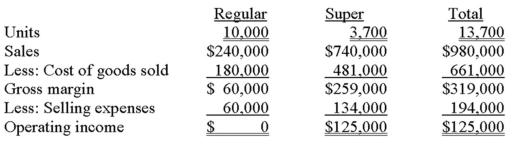

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Disregard the information in the previous question. If HiTech eliminates Regular and uses the available capacity to produce and sell an additional 1,500 units of Super, what would be the impact on operating income?

A) $28,000 increase

B) $45,000 increase

C) $55,000 increase

D) $85,000 increase

E) None of the other answers are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Lido manufactures A and B from a

Q11: Tri-County, Inc. is studying whether to expand

Q14: "It's close to a $40,000 loser

Q16: In early July, Jim Lopez purchased a

Q17: Mueller has been approached about providing a

Q18: Smythe Manufacturing has 27,000 labor hours

Q53: An opportunity cost may be described as:<br>A)

Q69: The following costs are relevant to the

Q70: A firm that decides to emphasize those

Q93: Managerial accountants:<br>A) rarely become involved in an