Multiple Choice

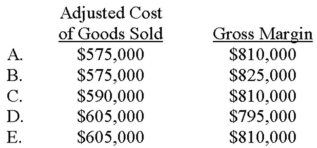

Fletcher, Inc. disposes of under- or overapplied overhead at year-end as an adjustment to cost of goods sold. Prior to disposal, the firm reported cost of goods sold of $590,000 in a year when manufacturing overhead was underapplied by $15,000. If sales revenue totaled $1,400,000, determine (1) Fletcher's adjusted cost of goods sold and (2) gross margin.

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A typical job-cost record would provide information

Q27: Kei Products uses a predetermined overhead application

Q28: Product costing in a manufacturing firm is

Q29: The journal entry needed to record $5,000

Q30: Metro Corporation uses a predetermined overhead rate

Q33: Buckman Corporation, which began operations on

Q35: Howard Manufacturing's overhead at year-end was underapplied

Q36: ADF provides consulting services and uses a

Q64: The primary difference between normalized and actual

Q95: The assignment of direct labor cost to