Essay

Dancer Corporation, which uses a job-costing system, had two jobs in process at the start of 20x1: job no. 59 ($95,000) and job no. 60 ($39,500). The following information is available:

• The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $720,000 and 20,000 hours, respectively.

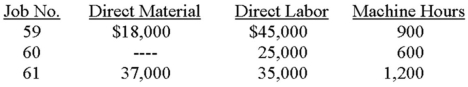

• The company worked on three jobs during the first quarter. Direct materials used, direct labor incurred, and machine hours consumed were:

• Manufacturing overhead during the first quarter included charges for depreciation ($20,000), indirect labor ($50,000), indirect materials used ($4,000), and other factory costs ($108,700).

• Dancer completed job no. 59 and job no. 60. Job no. 59 was sold for cash, producing a gross profit of $24,600 for the firm.

Required:

A. Determine the company's predetermined overhead application rate.

B. Prepare journal entries as of March 31 to record the following. (Note: Use summary entries where appropriate by combining individual job data.)

1. The issuance of direct material to production, and the direct labor incurred.

2. The manufacturing overhead incurred during the quarter.

3. The application of manufacturing overhead to production.

4. The completion of job no. 59 and no. 60.

5. The sale of job no. 59.

Correct Answer:

Verified

A. Predetermined ove...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: An accountant recently debited Work-in-Process Inventory and

Q33: The final step in recognizing the completion

Q38: Which of the following statements regarding work

Q60: Briefly describe the stages used in the

Q61: Media, Inc., an advertising agency, applies overhead

Q62: The selected data that follow relate

Q64: Pruitt Company has developed an integrated system

Q67: The estimates used to calculate the predetermined

Q68: Job no. C12 was completed in

Q69: Which of the following statements about manufacturing