Multiple Choice

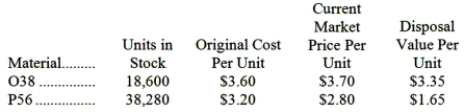

Stampka Corporation is a specialty component manufacturer with idle capacity. Management would like to use its extra capacity to generate additional profits. A potential customer has offered to buy 4,200 units of component JJF. Each unit of JJF requires 6 units of material O38 and 9 units of material P56. Data concerning these two materials follow:  Material O38 is in use in many of the company's products and is routinely replenished. Material P56 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up. What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product JJF?

Material O38 is in use in many of the company's products and is routinely replenished. Material P56 is no longer used by the company in any of its normal products and existing stocks would not be replenished once they are used up. What would be the relevant cost of the materials, in total, for purposes of determining a minimum acceptable price for the order for product JJF?

A) $146,790

B) $199,080

C) $155,610

D) $212,340

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A general rule in relevant cost analysis

Q20: Mckerchie Inc. manufactures industrial components. One of

Q77: Cranston Corporation makes four products in a

Q83: Two alternatives, code-named X and Y, are

Q95: The cost of a resource that has

Q96: Joint costs are not relevant to the

Q123: Talboe Company makes wheels which it uses

Q126: Redner, Inc. produces three products. Data concerning

Q134: The Kelsh Company has two divisions--North and

Q146: The constraint at Dalbey Corporation is time