Multiple Choice

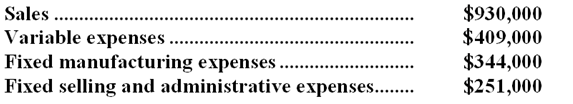

The management of Freshwater Corporation is considering dropping product C11B. Data from the company's accounting system appear below:  All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $122,000 of the fixed selling and administrative expenses are avoidable if product C11B is discontinued.

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further investigation has revealed that $211,000 of the fixed manufacturing expenses and $122,000 of the fixed selling and administrative expenses are avoidable if product C11B is discontinued.

-What would be the effect on the company's overall net operating income if product C11B were dropped?

A) Overall net operating income would decrease by $188,000.

B) Overall net operating income would increase by $74,000.

C) Overall net operating income would decrease by $74,000.

D) Overall net operating income would increase by $188,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Resendes Refiners, Inc., processes sugar cane that

Q28: Meacham Company has traditionally made a subcomponent

Q30: Block Corporation makes three products that use

Q31: Marrin Corporation makes three products that use

Q33: Austin Wool Products purchases raw wool and

Q34: The management of Heider Corporation is considering

Q35: Depreciation expense on existing factory equipment is

Q36: A customer has asked Twiner Corporation to

Q37: Humes Corporation makes a range of products.The

Q77: Cranston Corporation makes four products in a