Multiple Choice

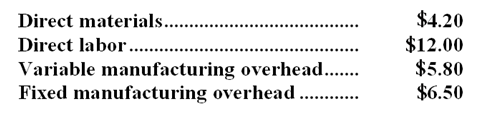

The Rodgers Company makes 27,000 units of a certain component each year for use in one of its products. The cost per unit for the component at this level of activity is as follows:  Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

Rodgers has received an offer from an outside supplier who is willing to provide 27,000 units of this component each year at a price of $25 per component. Assume that direct labor is a variable cost. None of the fixed manufacturing overhead would be avoidable if this component were purchased from the outside supplier.

-Assume that there is no other use for the capacity now being used to produce the component and the total fixed manufacturing overhead of the company would be unaffected by this decision.If Rodgers Company purchases the components rather than making them internally,what would be the impact on the company's annual net operating income?

A) $94,500 increase

B) $81,000 decrease

C) $237,600 decrease

D) $124,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Dodrill Company makes two products from

Q6: In a sell or process further decision,which

Q7: Two products,IF and RI,emerge from a joint

Q8: Coakley Beet Processors,Inc. ,processes sugar beets in

Q9: The management of Therriault Corporation is considering

Q11: Iwasaki Inc.is considering whether to continue to

Q12: Freestone Company is considering renting Machine Y

Q13: The Kelsh Company has two divisions--North and

Q14: Ellis Television makes and sells portable televisions.Each

Q15: Costs associated with two alternatives,code-named Q and