Multiple Choice

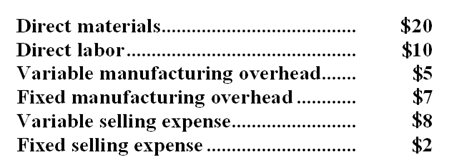

The Varone Company makes a single product called a Hom. The company has the capacity to produce 40,000 Homs per year. Per unit costs to produce and sell one Hom at that activity level are:  The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

The regular selling price for one Hom is $60. A special order has been received at Varone from the Fairview Company to purchase 8,000 Homs next year at 15% off the regular selling price. If this special order were accepted, the variable selling expense would be reduced by 25%. However, Varone would have to purchase a specialized machine to engrave the Fairview name on each Hom in the special order. This machine would cost $12,000 and it would have no use after the special order was filled. The total fixed costs, both manufacturing and selling, are constant within the relevant range of 30,000 to 40,000 Homs per year. Assume direct labor is a variable cost.

-If Varone can expect to sell 32,000 Homs next year through regular channels and the special order is accepted at 15% off the regular selling price,the effect on net operating income next year due to accepting this order would be a:

A) $52,000 increase

B) $80,000 increase

C) $24,000 decrease

D) $68,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Austin Wool Products purchases raw wool and

Q34: The management of Heider Corporation is considering

Q35: Depreciation expense on existing factory equipment is

Q36: A customer has asked Twiner Corporation to

Q37: Humes Corporation makes a range of products.The

Q39: Lusk Company produces and sells 15,000 units

Q40: Iaukea Company makes two products from a

Q41: Payne Company makes two products, M and

Q42: Glunn Company makes three products in a

Q43: The management of Freshwater Corporation is considering