Multiple Choice

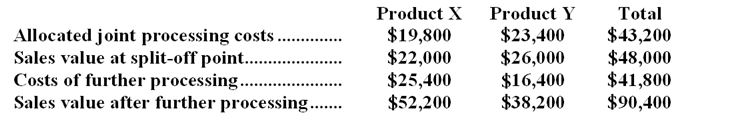

Dodrill Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

-What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

A) $26,800

B) $7,000

C) $4,800

D) $29,000

Correct Answer:

Verified

Correct Answer:

Verified

Q44: The Tingey Company has 500 obsolete microcomputers

Q45: The Tingey Company has 500 obsolete microcomputers

Q46: Which of the following are valid reasons

Q47: Redner,Inc.produces three products.Data concerning the selling prices

Q48: Condensed monthly operating income data for

Q50: Ethridge Corporation is presently making part H25

Q51: Part I51 is used in one of

Q52: Holvey Company makes three products in a

Q53: Fixed costs are irrelevant in a decision.

Q54: Nowlan Co.manufactures and sells trophies for winners