Multiple Choice

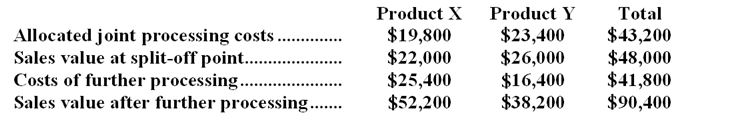

Dodrill Company makes two products from a common input. Joint processing costs up to the split-off point total $43,200 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

-What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

A) $(4,200)

B) $21,800

C) $24,400

D) $(1,600)

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Mckerchie Inc. manufactures industrial components. One of

Q21: Future costs that do not differ among

Q22: A customer has requested that Inga Corporation

Q23: Nutall Corporation is considering dropping product N28X.Data

Q24: The Cabinet Shoppe is considering the

Q26: Mckerchie Inc. manufactures industrial components. One of

Q27: Resendes Refiners, Inc., processes sugar cane that

Q28: Meacham Company has traditionally made a subcomponent

Q30: Block Corporation makes three products that use

Q77: Cranston Corporation makes four products in a