Essay

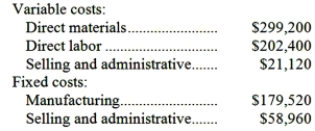

Nowlan Co. manufactures and sells trophies for winners of athletic and other events. Its manufacturing plant has the capacity to produce 11,000 trophies each month; current monthly production is 8,800 trophies. The company normally charges $87 per trophy. Cost data for the current level of production are shown below:  The company has just received a special one-time order for 500 trophies at $50 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

The company has just received a special one-time order for 500 trophies at $50 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

Correct Answer:

Verified

Only the direct materials and direct lab...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Two products,IF and RI,emerge from a joint

Q53: Fixed costs are irrelevant in a decision.

Q68: Galluzzo Corporation processes sugar beets in batches.A

Q82: A sunk cost is a cost that

Q97: Avoidable costs are also called relevant costs.

Q111: Cung Inc.has some material that originally cost

Q128: The Immanuel Company has just obtained a

Q143: Marrin Corporation makes three products that use

Q148: Part N29 is used by Farman Corporation

Q151: Payne Company makes two products, M and