Essay

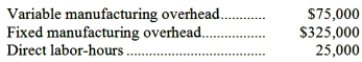

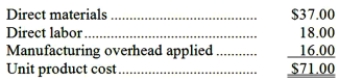

Humes Corporation makes a range of products. The company's predetermined overhead rate is $16 per direct labor-hour, which was calculated using the following budgeted data:  Management is considering a special order for 700 units of product J45K at $64 each. The normal selling price of product J45K is $75 and the unit product cost is determined as follows:

Management is considering a special order for 700 units of product J45K at $64 each. The normal selling price of product J45K is $75 and the unit product cost is determined as follows:  If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

If the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order.

Required:

If the special order were accepted, what would be the impact on the company's overall profit?

Correct Answer:

Verified

Direct materials, direct labor, and vari...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Knaack Corporation is presently making part R20

Q72: The opportunity cost of making a component

Q75: Janus Corporation has in stock 43,700 kilograms

Q105: Consider the following production and cost data

Q106: Block Corporation makes three products that use

Q107: Wright Company produces products I, J, and

Q109: Rojo Corporation has received a request for

Q111: Rothery Co. manufactures and sells medals for

Q112: Nutall Corporation is considering dropping product N28X.

Q113: Power Systems Inc. manufactures jet engines for