Multiple Choice

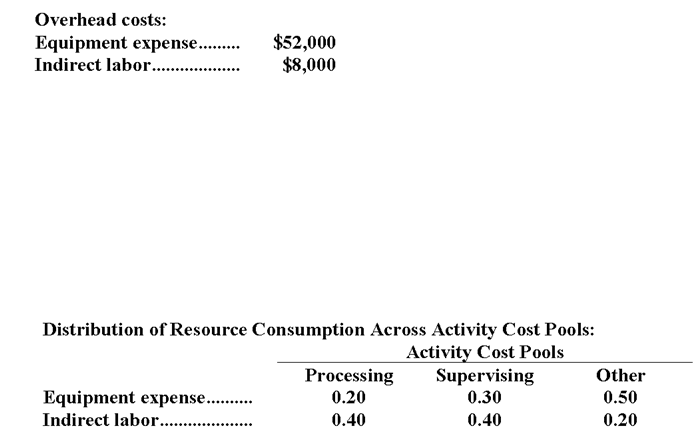

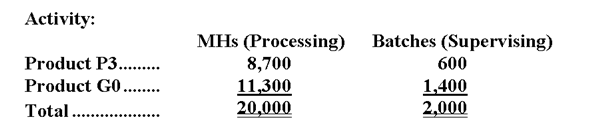

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

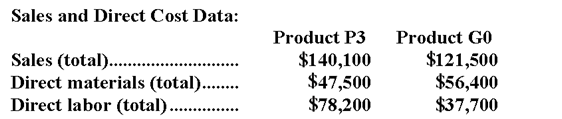

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the product margin for Product P3 under activity-based costing?

A) -$15,600

B) $2,844

C) $14,400

D) $8,484

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Dillner Company uses an activity-based costing system

Q32: Brisky Corporation uses activity-based costing to compute

Q33: Petitte Corporation has provided the following data

Q34: Capizzi Corporation has an activity-based costing system

Q35: The following data have been provided by

Q37: Dykema Corporation uses activity-based costing to compute

Q38: Demora Corporation's activity-based costing system has three

Q39: Ballweg Corporation has an activity-based costing system

Q40: Fogle Florist specializes in large floral bouquets

Q41: Groch Corporation uses activity-based costing to compute